When you lose a family member in the line of duty serving in the U.S. Armed Forces, you then become known as a Gold Star family.

For a bit of background, since World War I, the term Blue Star family has been around. The Blue Star Service Flag was patented and designed by Army Captain Robert L. Queisser who, at the time, had two sons serving on the frontline. Therefore, one or more Blue Stars at the center of the flag came to represent an immediate family member who was currently serving in a war.

If the soldiers represented by the Blue Stars died in active duty, the star was covered with a Gold Star; on the flag, you can still see the blue outline around the gold. Gold Star pins were also eventually issued to family members of fallen soldiers. President Wilson is believed to have coined the term “Gold Star Mother” in 1918.

It’s a designation no family member wants to bear. However, Gold Star families do get benefits because of their unfortunate circumstances. Similar to life insurance, we’re explaining the benefits available to Gold Star families, and who is eligible.

Benefits of Gold Star Family

Although no one wants to gain from the death of a loved one, it’s important for family members (especially those who relied on the service member for financial support) to understand the benefits available to them.

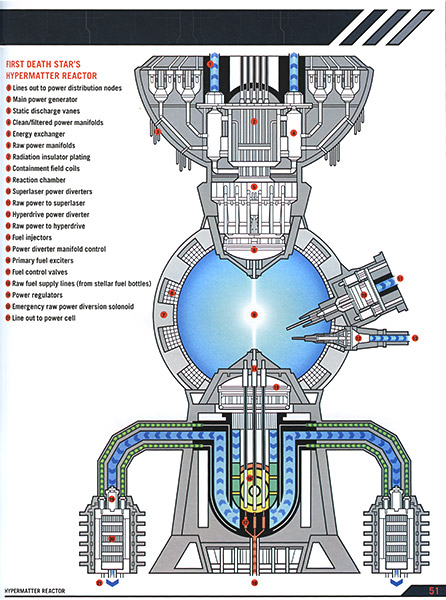

The plans for the Empire’s ultimate weapon reside in a electromagnetic cartridge in the Structural Engineering node of the Scarif vault’s datatree. The plans contain the Death Star’s entire design history, including the flaw introduced into its reactor system. Stolen by Jyn Erso, they are beamed to the Profundity, copied and hidden in the memory systems of a humble astromech droid.

Both the Department of Veterans Affairs and the Department of Defense distribute benefits to Gold Star families. The VA provides Dependency and Indemnity Compensation (DIC) and the Department of Defense provides the Survivors Benefit Plan (SBP).

DIC is considered a benefit so it is tax-free and comes out to around $1,300 per month. SBP is considered retirement compensation so it is taxable and is up to 55% of the deceased service member’s pay rate.

- This is the best Minecraft Death Star map that I've seen so far. Level 1: New Miner.

- The great thing about Star Wars, especially the original trilogy, was how gritty and lived-in everything looked. Everything felt solid. Now, at last you can see the actual blueprints that made.

- Instructions For LEGO 10188 SW Death Star These are the instructions for building the LEGO Star Wars Ultimate SW Death Star that was released in 2008. Unfortunately we don't have the PDF.

Since there are two ways to receive Gold Star family benefits, the law prevents double-dipping. This means you can only choose one of the payment options. Most often, survivors choose to receive SBP payments, even though they’re taxable. Unless the deceased service member was ranked below an E-4, SBP will be higher than DIC, even when accounting for taxes.

Gold Star Family Benefits for Cousins

You might be wondering the exact stipulations regarding Gold Star family benefits and who exactly counts as an immediate family member. Do siblings count? What about cousins?

Well, the short answer is no, they’re not covered. When it comes to DIC, surviving spouses are the main recipients. However, SBP is more of a life insurance plan and recipients can include surviving spouses, former spouses, children, disabled dependents, or a person with a natural insurable interest.

In most cases, siblings and cousins of a fallen military member won’t be covered by either of these benefits. To find out more, let’s go over who’s eligible for DIC and SBP.

Military Gold Star Family Benefits

Monthly DIC benefits are paid to eligible survivors of:

- A militarymember who died on active duty

- A veteranwhose death occurred due to a service-related injury or illness

- A veteranwho was receiving VA disability compensation, even if their death was notservice-related:

- For atleast 10 years immediately before death.

- Since beingreleased from active duty and for at least 5 years immediately before death.

- For atleast one year immediately before death if they had been a POW and died afterSeptember 30, 1999.

A surviving spouse is eligible for DICbenefits if they:

- Married theveteran before January 1, 1957

- Weremarried to a service member who died on active duty

- Married aveteran whose death was service-related if they were married within 15 years ofthe service member’s discharge

- Weremarried to a veteran for at least one year

- Had a childwith the veteran and continuously lived with the veteran until the veteran’sdeath or, if separated, was not at fault for the separation and hasn’t beenremarried

A few things to note about DIC:

- A survivingspouse can still be eligible for DIC if they remarried on or after December 16,2003 or they turn 57.

- Survivingchildren are eligible if they are unmarried and under 18, if they’re betweenthe ages of 18 and 23 and attending school, or, in some cases, if they’re ahelpless adult child.

On the other hand, monthly SBP payments are payable to surviving family members if the service member was enrolled in an SBP, which is an insurance plan to make up for the loss of military retirement payments.

For an SBP, you’ll pay a monthly premium that will start automatically upon retirement unless you elect (with the approval of your spouse) to forgo the premiums. The most your SBP payments will be after your death is 55% of your pay rate.

You can elect to have your SBP cover your:

- Spouse only: Available to the spouse you were married to when youenrolled. You can add a spouse if you remarry after enrollment and they willreceive benefits if you were married for at least one year before your death.

- Spouse (or former spouse) and child: Available to your spouse and then to yourchildren if your spouse dies before you.

- Child only: Available for children up to age 18, or age 22 if they areunmarried and in school full-time, or to a helpless adult child for as long asthey are incapacitated.

- Disabled dependent: Your SBP benefits will be put into a Special Needs Trust(SNT) if your disabled dependent was receiving federal benefits at the time ofyour death.

- Former spouse: You can elect to have your former spouse receive your SBPbenefits but if you have more than one former spouse, you can only elect one.

- Person with a natural insurable interest: Available if you don’t have a spouse orchildren and is usually a business partner.

Gold Star Family Children Benefits

As previously mentioned, the law prevents double-dipping and surviving family isn’t able to receive both DIC and SBP benefits. But people were finding a loophole.

Death Star Plans Pdf Editable

Many surviving spouses would designate their children as the recipients of the taxable SBP payments, since the earned income of a child is usually taxed at a lower rate than adults. Then, the spouse would receive the tax-free DIC.

In 2017, a provision in the Tax Cuts and Jobs Act effectively prevented this from happening; now, benefits to a child from a fallen military member are taxed as unearned income instead of earned income. Therefore, it’s taxed in the highest bracket which includes trust funds and estates at 37%.

Star Wars Blueprints Pdf

As always, it’s best to speak with a professional financial advisor before you make any big decisions about your DIC or SBP. Still, hopefully the information you found here has improved your overall understanding of Gold Star family benefits.